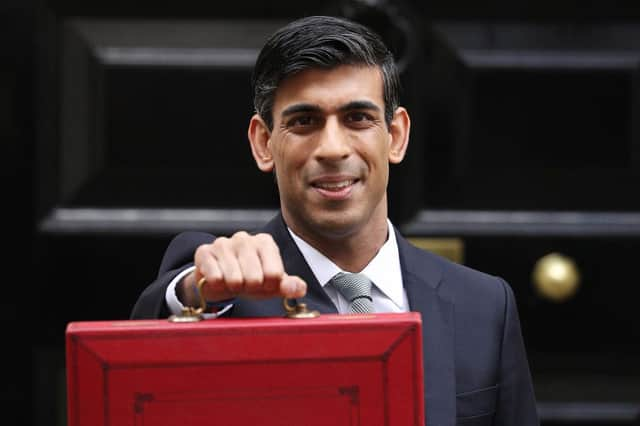

Rishi Sunak could launch a 'stealth tax raid' with next month's budget - here's what that means

The UK’s economy shrunk at its fastest rate since the 1920s last year, as the pandemic forced thousands of businesses to remain closed for several months.

The Office for National Statistics revealed that gross domestic product (GDP) dropped by 9.9%. In response, it is expected that Chancellor Rishi Sunak may make some drastic changes to his budget announcement, expected on 3 March, reports The Telegraph.

Advertisement

Hide AdAdvertisement

Hide AdTwo of his rumoured announcements – the unfreezing of fuel duty and a freeze on Personal Allowance – are being described as a “stealth tax raid”, and could bring in as much as £6 billion to the UK economy.

But the plans are being faced with criticism.

Here’s everything you need to know.

What would an unfreezing of Fuel Duty mean?

In March 2020, as part of his first budget as Chancellor, Sunak announced his decision to continue a freeze on fuel duty for the 11th year running.

That meant that the duty - a tax applied on top of VAT - remained at 57.95p per litre for petrol and diesel.

However, there are rumours that the Chancellor could undo the freeze with this year’s budget meaning which would see it begin to rise in line with inflation, as reported by The Sun.

Advertisement

Hide AdAdvertisement

Hide AdThat would essentially mean that the cost of filling up your car would increase per litre of fuel; while this may be good

In January, the price of petrol rose by 3.5p, reaching prices last seen just before the first lockdown was introduced on 22 March 2020.

The increase to 120p a litre marked the third consecutive month of price increases.

Simon Williams, RAC fuel spokesman, said at the time: “Petrol car drivers have sadly seen three months of rising pump prices taking us back to a level last seen at the start of the first lockdown late last March and adding a couple of pounds to the cost of filling up.

Advertisement

Hide AdAdvertisement

Hide Ad“Eyes will now be on the Chancellor who will face a difficult decision at his Budget next month as to whether to pile further misery on drivers by raising fuel duty at a time when pump prices are on the rise and many household incomes are being squeezed as a result of the pandemic.”

How would a freeze on Personal Allowance affect me?

The Personal Allowance is the amount of money a person a person can earn before they must pay Income Tax on it.

The standard Personal Allowance currently sits at £12,500 (though your Allowance may be bigger if you claim other benefits, and is smaller if your income is over £100,000).

In the wake of the pandemic, there have been calls to increase the Personal Allowance, meaning that people would be able to earn more money before tax.

Advertisement

Hide AdAdvertisement

Hide AdIn November, the Chancellor announced in his Spending Review that the threshold will rise by inflation – this year, that rate is 0.5 per cent.

While that would only have meant a rise of £70, Sunak is now thought to be planning a freeze, which would keep the rate as it is come the start of the new tax year on 6 April 2021.

According to The Telegraph, “freezing the thresholds would effectively cancel planned tax relief, with the average family forecast to miss out on a £250-a-year saving by 2024-25.”

In a poll carried out late last year by the Demos think tank, the majority of people said they would support a small rise in income tax for everyone but the least well off if taxes have to rise to pay for the coronavirus crisis.

Advertisement

Hide AdAdvertisement

Hide AdThe research suggested 58 per cent of the public would back increasing income tax for everyone by 2p in the pound, while raising the personal allowance to £20,000.

What is a stealth tax?

Stealth taxes are changes to tax and other financial levies that are made in subtle ways designed to allow them to go largely unnoticed by the general public.

Usually, no tax rates are actually increased, meaning a large amount of revenue can be raised, while minimising the risk of voter backlash.

Sunak’s rumours plans we see the Treasure recoup vast sums, while technically not breaking any of the Conservative party’s manifesto promises.

Advertisement

Hide AdAdvertisement

Hide AdMike Brewer, deputy director of economic think tank The Resolution Foundation, told The Telegraph that freezing income tax allowances is a “classic stealth tax”, and “a way to improve the fiscal outlook without generating much uproar.”

A version of this article originally appeared on our sister title, the Yorkshire Evening Post