Business Eye: Budget

Our friends at Bucks Herald Towers must have been delighted to hear him speak so lovingly of local newspapers as ‘a vital part of community life’ and ‘a vital part of a healthy democracy’.

With over 150 having shut their doors in the past 6 years, the tax concessions will be welcome.

Advertisement

Hide AdAdvertisement

Hide AdThe Mix 96 team must have been wondering that local radio surely makes a similar contribution to local life.

It was confidence-building to be told that we are the fastest growing economy in the western world, growing 50% faster than Germany and seven times faster than France.

In point of fact, the Battle of Agincourt received twice as many references as did the NHS, a point the opposition were quick to point out.

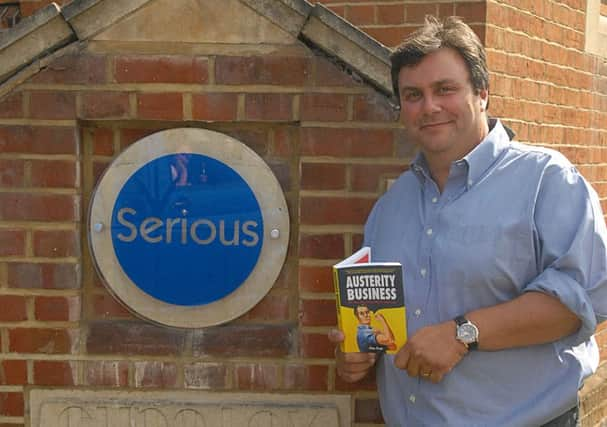

Further tax incentives for the creative industries will provide a major boost to Bucks, which through Pinewood Studios and the National Film and Television School can rightly lay claim to being the poster child for UK Film and TV.

Advertisement

Hide AdAdvertisement

Hide AdThe scrapping of class two national insurance will be welcomed because we have a large self-employment base, as will the averaging of incomes for tax purposes for farmers who have been getting caught by huge swings in the prices paid for food.

Sadly, the usual talk of the Northern Powerhouse and major investments in the South West were not matched by a similar commitment here.

The charting of a course to an £8 minimum wage will have been welcomed by many and was a cute political move ahead of an election, but building more rigidity and cost into our goods surely must at some point start hitting jobs and growth.

This sits on top of the huge effective new tax burden on business that is in play in the shape of auto-enrolment pensions.

Advertisement

Hide AdAdvertisement

Hide AdIt remains abundantly clear that our debt burden is colossal and according to the Chancellor some £30billion more government cuts are needed in a continuing austerity drive.

It is the speed and severity of the necessary spending cuts which is what now separates the fiscal positions of the three main parties.

This budget will however probably be most remember for its abolition of the Annual Tax Return and the long overdue root and branch review of business rates which have been grossly unfair and a drag on growth for some time now.